- What Is The Difference Between Nominal And Real Money Supply

- What Is The Difference Between Nominal And Real Money Supply Calculator

The relationship between money supply and price level lies in the fact that the amount of money in circulation in an economy has a direct impact on the aggregate price level. This is mainly because an abundance of money leads to an increase in demand for goods and services, while a scarcity of money has the opposite effect. In economic terms, this effect is explained by the quantity theory of money, which states that the amount of money in supply in an economy has a direct bearing on the price level.

A simple way of looking at the relationship between money supply and price level is to consider the fact that consumers will only spend when they have something to spend. That is to say that when there is a lot of money in the economy, people will have more to spend. This increase in demand also causes a corresponding increase in the price level. Excess liquidity leads to a situation in which a lot of cash will be vying for an often limited supply of goods. This causes the money to gradually lose its value, which consequently leads to price increases.

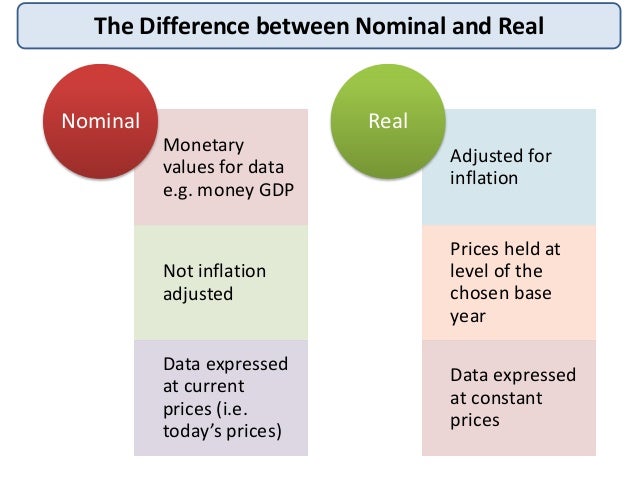

The velocity of money is a measurement of the rate at which money is exchanged in an economy. High money velocity is usually associated with a healthy, expanding economy. Low money velocity is usually associated with recessions and contractions. According to the Quantity Theory of Money, inflation depends on the money supply and its velocity. Nominal GDP is the value of final goods and services produced in a country given in a particular period of time where as Real GDP is the value of final goods and services including the effect of inflation in an economy. Real GDP reflect current GDP at base year prices but Nominal GDP represent current GDP at current prices. Feb 02, 2000 Real money demand is graphed holding fixed real income and expected inflation. The real money supply is equal to the nominal amount of M1, denoted M 0, divided by the fixed aggregate price level, P 0. It is assumed that the Fed does not alter the money supply based on the valued of the real interest rate.

Economists rely on the relationship between money supply and price level as one of the indicators of the state of the economy. When there is a rise in the aggregate price, one of the chief factors responsible is too much demand caused by consumers having easy access to money. The response of the government to this is often to introduce monetary or fiscal policies meant to restrict the ease with which consumers can obtain money, including bank loans and various types of credit. One method by which the government can restrict access to money is through increases in general interest rates.

The effect of this restriction further illustrates the relationship between money supply and price level, because this maneuver usually forces the price level to drop. When the central bank of a country increases the interest rate, consumers may find the conditions attached to obtaining money to be either too prohibitively expensive or too rigorous, as other banks tighten their lending policies in response to the interest rates increase. As a consequence of the lack of easy access to funds, consumers tend to become more conservative in their spending habits, leading to a drop in the demand for goods and services. The consequence of a reduction in demand is an accompanying drop in the prices of goods and services.

Last updated: February 2, 2000

Note: These notes are preliminary and incomplete and they are not guaranteed to be free of errors. Please let me know if you find typos or other errors.

The Asset Market

Up to now we have covered (1) the labor market and the production function, where real wages, employment and potential output is determined, and (2) the market for goods and services, where the real interest rate and investment and saving are determined. Now we consider the market for financial assets (money and 'bonds') by focusing on the demand and supply of money in the economy. This will give us insights into other forces on interest rates - particularly those created by the Fed - and also on the ultimate determinants of inflation.

What is Money?

- Medium of exchange - barter is inefficient.

- Unit of account - money is the basic unit for measuring economic value.

- Store of value - money can be used to hold wealth.

- Low return (interest rate) - money pays no interest

- Low risk - money is a 'safe' asset in low inflation times

- High liquidity - money is the most liquid asset (money is accepted immediately for almost all transactions)

Definitions of monetary aggregates

| Symbol | Assets Included | Billions of dollars (1996) |

| C | Currency | $358.9 |

| M1 | Currency, demand deposits, traveler's checks, checkable deposits. | $1,095.3 |

| M2 | Currency, M1, overnight repos, eurodollars, money market deposit accounts, money market mutual funds, saving and small time deposits. | $3,761.1 |

In this class, when we talk about the nominal money supply we will generally be referring to the monetary aggregate M1. Hereafter, the symbol 'M' will denote M1.

The supply of money

The Federal Reserve Bank (Fed)

The Federal Reserve Bank (Fed) ultimately controls the supply of money in the economy. (How it does this and how the banking system works is detailed in the lectures on the Fed and Monetary Policy.) The Fed is the central bank for the U.S. and is a quasi-private entity (technically owned by private banks) created by the Federal Reserve Act in 1913. There are twelve regional Federal Reserve Banks across the country and the leadership of the system is conducted by the Board of Governors of the Federal Reserve System (Federal Reserve Board ). The Board consists of seven governors, appointed by the President to staggered fourteen-year terms. The President appoints one Board member as chairman - currently Allen Greenspan - for a term of four years. It is important to keep in mind that the Fed operates independently of the federal government. Congress and the President do not have direct control over the operations of the Fed.

How the Fed Controls the Money Supply

The Fed primarily controls the supply of money (M1) in the economy through what are called open market operations. These are the purchase and sale of government bonds by the Fed. The Fed operates the printing presses for the creation of currency. The Fed also owns a substantial amount of U.S. government bonds. When the Fed wants to increase the supply of money it performs an open market purchase of government bonds. That is, the Fed buys (by printing money) outstanding government bonds from the public or new government bonds from the Treasury (to finance the current deficit). This operations injects new cash into the economy. Conversely, when the Fed wants to decease the amount of money in the economy it performs an open market sale of government bonds. Here, the Fed sells some of its holdings of government bonds to the public in exchange for cash. This operation takes cash out of the economy.

Portfolio Allocation and the Demand for Assets

Portfolio theory tells us how individuals allocate their wealth among a number of financial assets (e.g. stocks, bonds, real estate, money). In general an individual's demand for assets is based on comparing the benefits of costs of holding different kinds of assets. These costs and benefits are functions of the following assets characteristics:

- Expected return - expected gain (or loss) from holding an asset over a particular investment horizon

- Risk - the degree of uncertainty in an asset's return

- Liquidity - the ease and quickness that an asset can be traded

An individual's demand for money is then based on the costs and benefits of holding money. As an asset, money has a very low expected return (it pays no interest), is very safe (the gov't guarantees its nominal value) and is the most liquid asset.

Simplifying assumptions

Since the general asset allocation problem involves many different kinds of assets with different risk and return characteristics we simplify this decision by assuming that there are only two kinds of financial assets in the economy.

- Money assets - low return, high liquidity and low risk. im = nominal interest rate on money assets (very low).

- Non-money assets (bonds) - higher return than on money assets and less liquidity. We assume that the risk associated with investing in bonds is not too high (think of government bonds as the generic non-money asset). Let i denote the nominal interest rate on non-money assets. Note that, by assumption, i > im. Also, recall that i = r +pe, where r denotes the real return on non-money assets and pe denotes expected inflation.

Behavorial Model for Money Demand

Our model for the demand for nominal money balances takes the following form

Md = P·Ld(Y, i)

where

What Is The Difference Between Nominal And Real Money Supply

- Md = demand for nominal money balances (demand for M1)

- Ld= demand for liquidity function

- P = aggregate price level (CPI or GDP deflator)

- Y = real income (real GDP)

- i = nominal interest rate on non-money assets

Discussion

- Nominal money demand is proportional to the price level. For example, if prices go up by 10% then individuals need 10% more money for transactions.

- As Y increases, desired consumption increases and so individuals need more money for the increased number of desired transactions. This is the liquidity demand for money.

- As the nominal interest rate on non-money assets (bonds), i, increases the opportunity cost of holding money increases and so the demand for nominal money balances decreases.

- Since i = r + pe, we can decompose the effects on an increase in i into real interest rate increases (holding expected inflation fixed) and expected inflation increases (holding the real interest rate fixed).

The demand for real balances

Since the demand for nominal balances is proportional to the aggregate price level, we can divide both sides of the nominal money demand equation by P. This gives the liquidity demand function or the demand for real balances function:

MD = Md/P = Ld(Y, i)

The left-hand-side of the above equation is the demand for nominal balances divided by the aggregate price level or the demand for real balances (the real purchasing power of money). The right-hand side is the liquidity demand function. The demand for real balances is decomposed into a transactions demand for money (captured by Y) and a portfolio demand for money (captured by i).

The real money demand function is graphed below:

Whenever income or expected inflation change the real money demand curves shifts. For example, if Y increases the real money demand function shifts up and right; if expected inflation increases the real money demand function shifts down and left.

Equilibrium in the money market

Real money demand and the real money supply as functions of the real interest rate are illustrated in the above graph. Real money demand is graphed holding fixed real income and expected inflation. The real money supply is equal to the nominal amount of M1, denoted M0, divided by the fixed aggregate price level, P0. It is assumed that the Fed does not alter the money supply based on the valued of the real interest rate. Therefore, the real money supply function is a vertical line in the graph with the real interest rate on the vertical axis and real money balances on the horizontal axis.

Notice that real money demand and real money supply intersect when the real interest rate is r0. This is the value of the real interest that equates money demand with the money supply and establishes equilibrium in the money market. When the money market is in equilibrium there are no economic forces acting on the economy to alter the real interest rate.

If the real interest rate were r1 then the demand for real balances would be greater than the fixed supply of real balances (as illustrated above). In this case we say there is an excess supply of money in the money market. Practically, what this means is that individuals are holding more money than they would like given the high real interest rate. Accordingly, individuals will attempt to rebalance their portfolios; i.e. they will try to get rid of money by buying bonds (our generic non-money asset). In doing so the demand for bonds increases and so the price of bonds increases. Because bond prices are inversely related to the interest rate on bonds, the increased price of bonds lowers the real return on bonds (holding expected inflation fixed). Therefore, the excess supply of money at r1 (dis-equilibrium in the money market) leads to economic forces that act to lower the real interest rate. These forces cease to operate when the real interest falls to r0 where the demand for real balances is equal to the supply of real balances.

Comparative statics

Increase in the nominal money supply (M)

What Is The Difference Between Nominal And Real Money Supply Calculator

Consider the money market initially in equilibrium at r = 6% as illustrated in the above graph.. Suppose the Fed increases the nominal money supply by an open market purchase of government bonds. This increases the money supply from M0 to M1. Holding the price level fixed, this increases the supply of real balances from M0/P0to M1/P0. If the real interest rate stays at 6% then the supply of real balances will be greater than the demand for real balances: there will be an excess supply of money in the money market. Consequently, individuals will try to get rid of the excess money by buying bonds which puts downward pressure on the real interest rate (holding expected inflation fixed). As r drops we move along the liquidity demand curve toward the new equilibrium at r = 5%.

Increase in the aggregate price level (P)

Consider the money market initially in equilibrium at r = 6% described in the graph below. Now suppose that the aggregate price level increases from P0 to P1. Holding the nominal money supply fixed, this reduces the supply of real balances from M0/P0 to M0/P1. If the real interest rate stays at 6% the supply of real balances will be less than the demand for real balances: there will be an excess demand for money. The excess demand for money will prompt individuals to sell bonds (demand for bonds falls) and so the real interest rate on bonds will rise. As r rises, we move up along the liquidity demand curve toward the new equilibrium at r = 7%.

Consider the money market in equilibrium at r = 6% as illustrated above. Suppose that current income (Y), which is the same as current output (GDP),. Increases from Y0 to Y1. This increases the transactions demand for money as so the real money demand curve shifts up and to the right. If the real interest rate stays at 6% there will be an excess demand for money which puts upward pressure on the real interest rate. As r increases, we move along the money demand curve up towad the new equilibrium at r = 8%.