Corrections

All material on this site has been provided by the respective publishers and authors. You can help correct errors and omissions. When requesting a correction, please mention this item's handle: RePEc:aea:jecper:v:12:y:1998:i:2:p:223-34. See general information about how to correct material in RePEc.

For technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: . General contact details of provider: https://edirc.repec.org/data/aeaaaea.html .

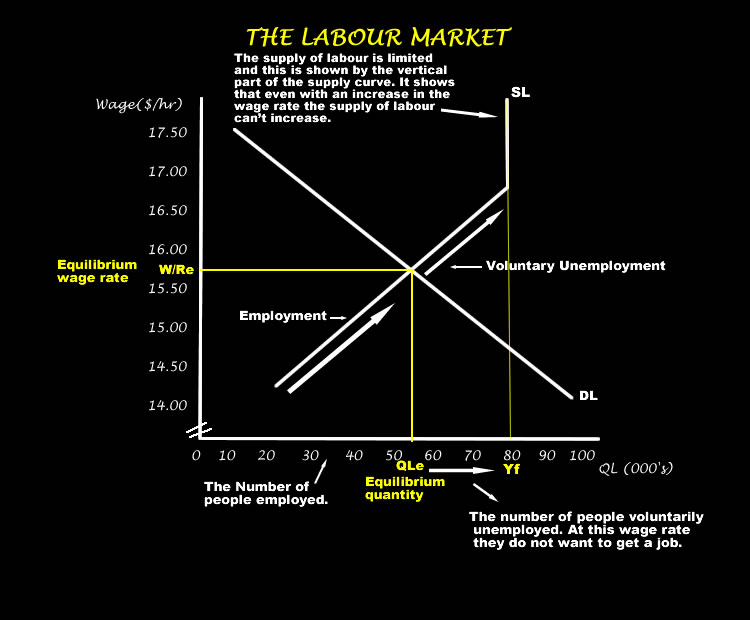

The nominal wage rate is the average hourly wage rate measured in current dollars and the real wage rate is the average hourly wage rate measured in dollars of a given reference base year. Real wage rate by FSCJ is licensed under CC-BY-4.0. The real wage rate is the quantity of goods and services that an hour’s work can buy. In terms of definitions, ‘Real wages’ is the average wage per capita and ‘Productivity’ can be expressed by the following equation where Productivity is equal to Total Factor Probability (Q), Q = f (L + K) x T where L = labour, K = Capital invested and T = Technology. This concept is essential in macroeconomics to describe an economy.

If you have authored this item and are not yet registered with RePEc, we encourage you to do it here. This allows to link your profile to this item. It also allows you to accept potential citations to this item that we are uncertain about.

If CitEc recognized a bibliographic reference but did not link an item in RePEc to it, you can help with this form .

If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item. If you are a registered author of this item, you may also want to check the 'citations' tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation.

For technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: Michael P. Albert (email available below). General contact details of provider: https://edirc.repec.org/data/aeaaaea.html .

Please note that corrections may take a couple of weeks to filter through the various RePEc services.

Nominal and Real Values

Dollars and Cents at Different Dates

To compare dollar amounts at different dates, we need to know the CPI on those dates. To convert the price of a good in past dollars (Year 2) to its price in current dollars (Year 1), use the following formula:

Value in Year 1 dollars = {(CPI in Year 1) ÷ (CPI in Year 2)} x Value in Year 2 dollars

Notice that in the above formula, Year 2 does not necessarily have to be greater than Year 1. Thus, the formula works for any two years.(17)

Nominal and Real Values in Macroeconomics

The difference between nominal and real variables is important in macroeconomics. In macroeconomics, we generally use the GDP deflator rather than the CPI as our measure of the price level because we are dealing with economy totals, of which consumer spending is just one part.

The calculation of the real wage is similar to the calculation of real GDP, only using a different set of variables. (17)

Real wage = (Nominal wage) ÷ (CPI)

Real GDP = (nominal GDP) ÷ (GDP deflator)

Nominal GDP and Real GDP

Nominal Wage Rate and Real Wage Rate

The nominal wage rate is the average hourly wage rate measured in current dollars and the real wage rate is the average hourly wage rate measured in dollars of a given reference base year.

The real wage rate is the quantity of goods and services that an hour’s work can buy.

Between 1981 and 2011, the nominal wage rate more than doubled, but the real wage rate stayed roughly constant because the increase in the nominal wage rate just kept up with inflation. (17)

Wage And Works

Nominal Interest Rate and Real Interest Rate

The nominal interest rate is the percentage return on a loan calculated by using dollars. The real interest rate is the percentage return on a loan calculated by using purchasing power; it’s the nominal interest rate adjusted for the effects of inflation.

What Do You Mean By Real Wage

Real interest rate = Nominal interest rate – Inflation rate

Hourly Wage Rates By State

The calculation of the real interest rate also “deflates” the nominal interest rate. However, because the numbers are already percentages, we must subtract the percentage change in prices (the inflation rate) rather than divide by the price level. When the inflation rate was high, during the 1970s and early 1980s, the gap between the real interest rate and the nominal interest rate was large. The real interest rate was negative in the mid-to-late 1970s and very high in the early 1980s, but has shown no real upward or downward trend since 1971. (17)