Figure 25.12 An Increase in the Money Supply. The Fed increases the money supply by buying bonds, increasing the demand for bonds in Panel (a) from D 1 to D 2 and the price of bonds to P b 2. This corresponds to an increase in the money supply to M′ in Panel (b). The interest rate must fall to r 2 to achieve equilibrium.

In equilibrium, money demand always equal to money supply. Therefore, (M^{d}=M).

Substitute (M^{d}) by (M) in money demand equation:

[frac{M}{P}=Y^{r}cdot underset{(-)}{L(i)}] - In equilibrium, real money supply ((frac{M}{P})) is equal to real GDP ((Y^{r})) times some decreasing function of interest rate ((L(i))).

Given price level ((P)) and money supply ((M)), so that real money supply ((frac{M}{P})) is given. You need higher interest rate to offset the increase on money demand driven by higher real GDP ((Y^{r})).

Intuitively, higher real GDP ((Y^{r})) means more goods and services on the market for transactions, which leads to higher money demand. However, real money supply ((frac{M}{P})) is given, consumers are selling bonds for money. Bond issuers have to offer higher interest rate ((i)) to attract buyers.

Alternatively, higher real GDP ((Y^{r})) means higher income, which leads to more consumption (transactions). However, real money supply ((frac{M}{P})) is given, consumers are selling bonds for money. Bond issuers have to offer higher interest rate ((i)) to attract buyers.

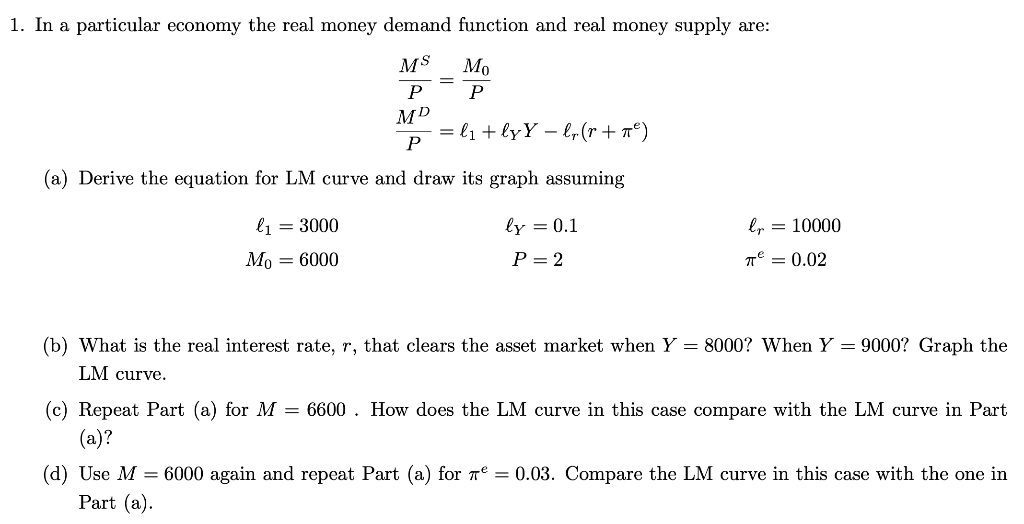

1. Suppose the real money demand function is: Md/P ? 1500 ? 0.2 Y – 10,000 (r ? (e). Assume M ? 4000, P ? 2.0, (e ? 0.01, and Y ? 5000. Note: we are holding P and Y constant in this problem until we get to case #2, see below. a) What is the market clearing real interest rate? Show your results on a real money supply, real money demand diagram and label this initial equilibrium point as point A. Be sure to label your graph completely! Be sure to put relevant shift variables in parentheses next to the appropriate function.

1. Suppose the real money demand function is: Md/P ? 1500 ? 0.2 Y – 10,000 (r ? (e). Assume M ? 4000, P ? 2.0, (e ? 0.01, and Y ? 5000. Note: we are holding P and Y constant in this problem until we get to case #2, see below. a) What is the market clearing real interest rate? Show your results on a real money supply, real money demand diagram and label this initial equilibrium point as point A. Be sure to label your graph completely! Be sure to put relevant shift variables in parentheses next to the appropriate function. Case #1 b) Suppose Bernanke and the Fed were successful in their campaign to raise inflationary expectations to 4% (.04). Why would they want to do this? Use the Fisher equation to support your argument. c) Solve for the real interest rate that clears the money market given the change in inflationary expectations. Please show work and Label this new point as point B on your diagram. d)) Explain how this strategy of raising inflationary expectations is supposed to stimulate output. Recall that output is equal to C + I + G! Be very specific as this question is worth 10 points. Hint: The price of current consumption in terms of future consumption and the user cost of capital most definitely needs to be in your response. Case #2 e) Let us return to our original conditions. Please redraw the original graph locating point A (this is with (e ? 0.01, we are holding expected inflation constant in case #2). We now experience some economic growth so that Y = 6000. This is the only change. Resolve for the market clearing real rate of interest and label on your diagram as point B. Please show all work. Be sure to put relevant shift variables in parentheses next to the appropriate function. f) Now explain exactly why the real rate of interest had to change the way it did to clear the money market. Please be clear with the intuition being sure to refer to the bond market in your answer. You should begin your response with “At…

Get Professional Assignment Help Cheaply

Are you busy and do not have time to handle your assignment? Are you scared that your paper will not make the grade? Do you have responsibilities that may hinder you from turning in your assignment on time? Are you tired and can barely handle your assignment? Are your grades inconsistent?

Whichever your reason may is, it is valid! You can get professional academic help from our service at affordable rates. We have a team of professional academic writers who can handle all your assignments.

Our essay writers are graduates with diplomas, bachelor's, masters, Ph.D., and doctorate degrees in various subjects. The minimum requirement to be an essay writer with our essay writing service is to have a college diploma. When assigning your order, we match the paper subject with the area of specialization of the writer.

Why Choose Our Academic Writing Service?

- Plagiarism free papers

- Timely delivery

- Any deadline

- Skilled, Experienced Native English Writers

- Subject-relevant academic writer

- Adherence to paper instructions

- Ability to tackle bulk assignments

- Reasonable prices

- 24/7 Customer Support

- Get superb grades consistently

How It Works

1. Place an order

You fill all the paper instructions in the order form. Make sure you include all the helpful materials so that our academic writers can deliver the perfect paper. It will also help to eliminate unnecessary revisions.

2. Pay for the order

Real Money Supply Function Calculator

Proceed to pay for the paper so that it can be assigned to one of our expert academic writers. The paper subject is matched with the writer’s area of specialization.

3. Track the progress

You communicate with the writer and know about the progress of the paper. The client can ask the writer for drafts of the paper. The client can upload extra material and include additional instructions from the lecturer. Receive a paper.

4. Download the paper

Real Money Supply Equation

The paper is sent to your email and uploaded to your personal account. You also get a plagiarism report attached to your paper.

Real Money Supply Function Graph

PLACE THIS ORDER OR A SIMILAR ORDER WITH USA ELITE WRITERS TODAY AND GET AN AMAZING DISCOUNT