- Nominal Money Demand And Real Money Demand Worksheet

- Real Money Demand And Nominal Money Demand

- Nominal Money Demand And Real Money Demand Graph

- Money Demand Shift

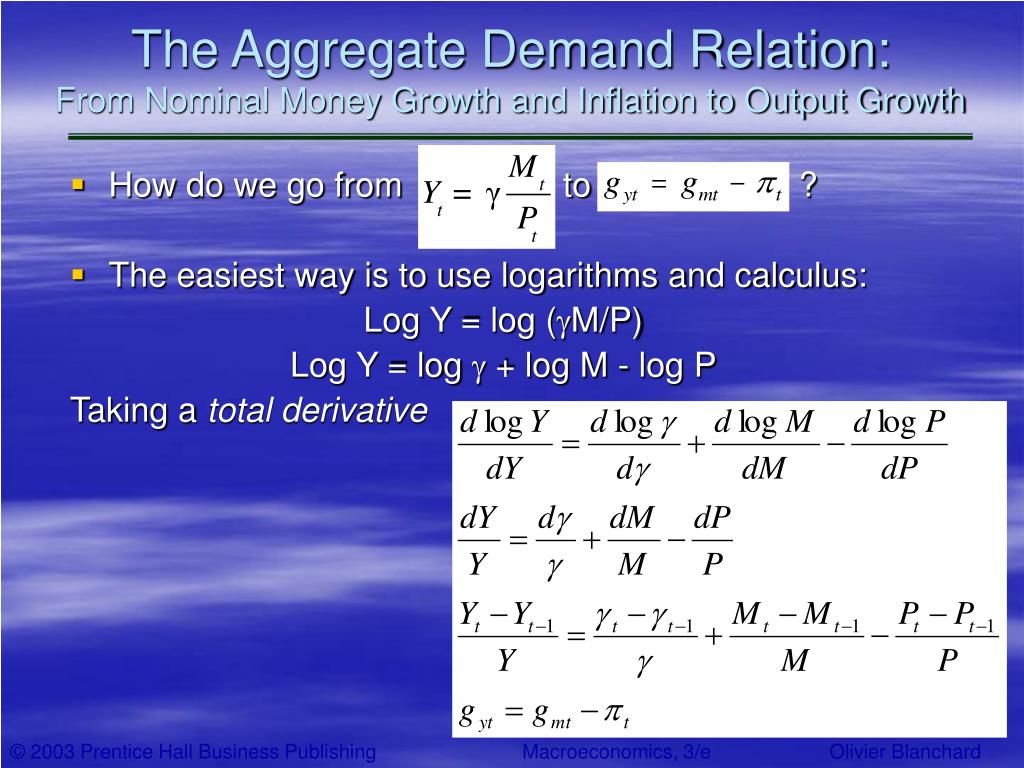

- Velocity, Money Demand, and the Quantity Theory I The terms velocity' and money demand' are often used interchangeably I Re-write in terms of real balances (purchasing power of money): M t P t = 1 V t Y t I The demand for real balance is proportional to the real quantity of exchange I 1 V t is the demand shifter' demand for money goes up.

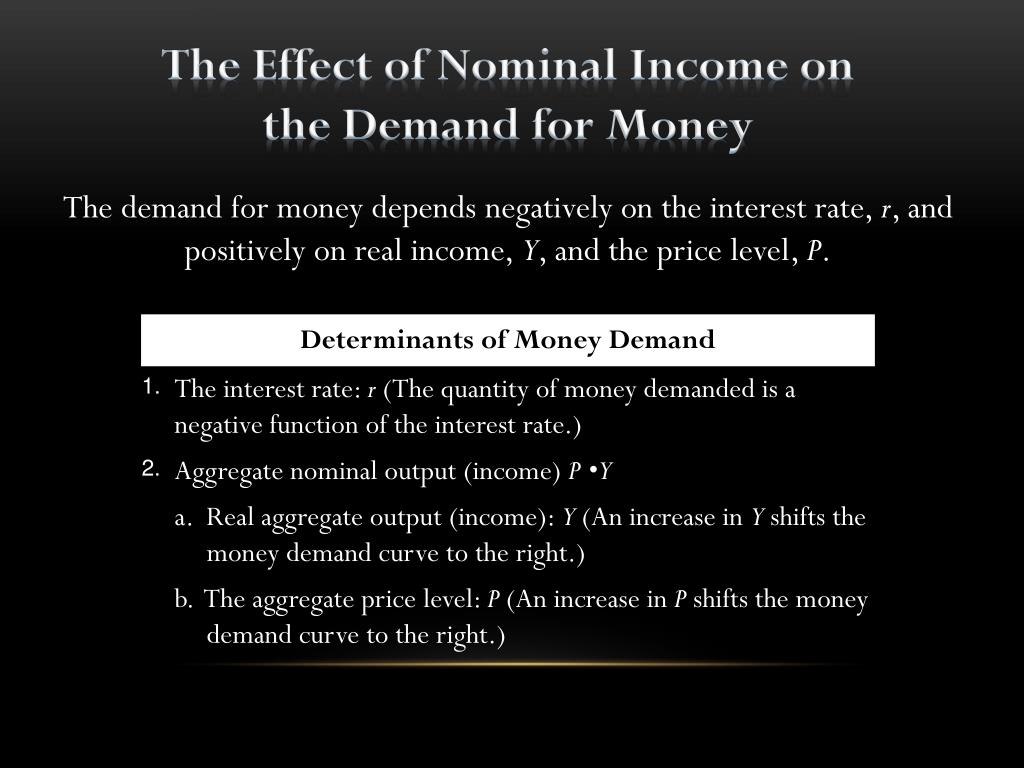

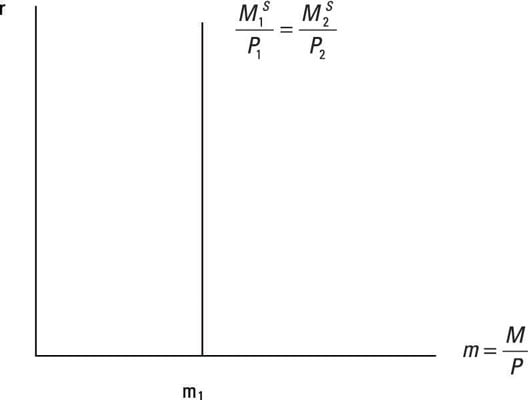

- Generally, the nominal demand for money increases with the level of nominal output (price level times real output) and decreases with the nominal interest rate. The real demand for money is defined as the nominal amount of money demanded divided by the price level. For a given money supply the locus of income-interest rate pairs at which money demand equals money supply is known as the LM curve.

If nominal money demand doubles and the real money supply also does what happens to the price level ( ). The price level increases by a factor of four b. The price level doubles ). The price level is unchanged. The price level falls by one-half. IL Short-Answer O stiens (19 points) 5. (7 points) If the Federal Reserve sold government.

Assume that the demand for real money balance (M / P) is M / P = 0.6Y – 100i, where Y is national income, and i is the nominal interest rate (in percent). The real interest rate r is fixed at 3 percent by the investment and saving functions. The expected inflation rate equals the rate of nominal money growth.

a.If Y is 1,000, M is 100, and the growth rate of nominal money is 1 percent, what must i and P be?

b.If Y is 1,000, M is 100, and the growth rate of nominal money is 2 percent, what must i and P be?

The Demand for Money on the Basis of its Functions!

The basic point about the demand for money is that individuals are interested in the purchasing power of their money holdings — the value of their cash balances in terms of the goods the cash will buy.

So money demand increases in proportion to the increase in the price level, given the constancy of the real variables such as the interest rate, real income and real wealth.

ADVERTISEMENTS:

An individual is assumed to be free from money illusion if a change in the level of prices, holding all real variables constant, leaves real behaviour, including real money demand, unchanged. By contrast, an individual whose real behaviour is affected by a change in the price level, all real variables remaining unchanged, is said to suffer from money illusion.

The demand for money is important in determining the effectiveness of fiscal policy in changing the level of income. Changes in fiscal variables, such as tax rates or government spending, affect the level of income if the demand for money changes when the interest rate changes — if the demand for money is interest-elastic.

If the demand for money is totally interest-inelastic — if it does not react at all to changes in the interest rate — increases in government spending totally crowd out private spending and leave the level of income unaffected. The demand should increase as the level of real income rises and decrease as the nominal interest rate rises.

The concept of demand for money originates from the Cambridge version of the quantity theory of money. According to this theory the demand for money is essentially one of real balances (M/P)d and is proportional to income. It is presented as (M/P)d = kY

where k is the fraction or proportion of income (Y) which people desire to hold in the form of real balance. The Cambridge economists used the concept of demand for money to show the link between money and prices.

Keynes, however, extended the concept of demand for money and considered a more general and realistic money demand function that assumes the demand for real money balances to depend on both the income and the rate of interest:

(M/P)d = f(Y, i),

where i is the nominal interest rate.

ADVERTISEMENTS:

Nominal Money Demand And Real Money Demand Worksheet

The link between money and interest rate was also shown by the IS-LM model developed in Chapter 9. It may be recalled that the shape of the LM curve depends on interest elasticity of demand for money. Keynes distinguished among three motives in people’s demand for money — a transaction motive, a precautionary motive, and a speculative motive.

Real Money Demand And Nominal Money Demand

The post- Keynesian economists have refined these categories and Keynes’ classification scheme has been revised somewhat. In particular, W. J. Baumol and James Tobin have said much more about the determinants of the demand for money than Keynes and the classicists. Milton Friedman has also restated the quantity theory of money.

A related point may also be noted at the outset. We know that money performs three main functions: it is a unit of account, a store of value, and a medium of exchange. The first function — money as an unit of account — does not generate any demand for money, because one can quote prices in money (in rupee or dollar) without holding it.

By contrast, money can serve its two other functions only if people hold it. Alternatively stated, theories of demand for money emphasise the role of money either as a store of value or as a medium of exchange. See Fig. 19.1 which is self-explanatory.

Nominal Money Demand And Real Money Demand Graph

To start with we discuss the Keynesian theory of demand for money. It has subsequently been extended in two other directions, to which we turn later.

Money Demand Shift

The classical economists were concerned with transactions demand for money because, to them, money was just a medium of exchange. According to the Cambridge version of the quantity theory of money the demand for money is expressed as

Md = kPY … (1)

In this equation money demand is proportional to nominal income (the price level, P, times real income, Y). In equilibrium situations the proportion of income held in the form of money (k) was assumed to remain fairly stable.

ADVERTISEMENTS:

Alternatively, the Fisher version of the quantity theory of money is written as MV = PY … (2)

The velocity of money (V), equal to 1/K was assumed to remain stable. In the classical analysis, the rate of interest did not affect money demand.