Calculate Real GDP. In a second step, we can now calculate real GDP. Unlike nominal GDP, real GDP shows the monetary value of all finished goods and services within an economy valued at constant prices. That means, we choose a base year and use the prices of that year to calculate the values of all goods and services for all the other years.

- How To Calculate Velocity Of Money With Real Gdp Equation

- How To Calculate Velocity Of Money With Real Gdp And Interest Rate

Intermediate Macroeconomics Sample Problems |

Contents

1. The Classical Quantity Theory of Money2. The Short-run Keynesian View

3. Fiscal and Monetary Policy and the Great Depression

4. Friedman and the Monetarists

1. The Classical Quantity Theory of Money

Summary

- Start with accounting identity: M x V = P x Q:

Money Supply x Velocity = Average Price Level x Real Output (GDP), or

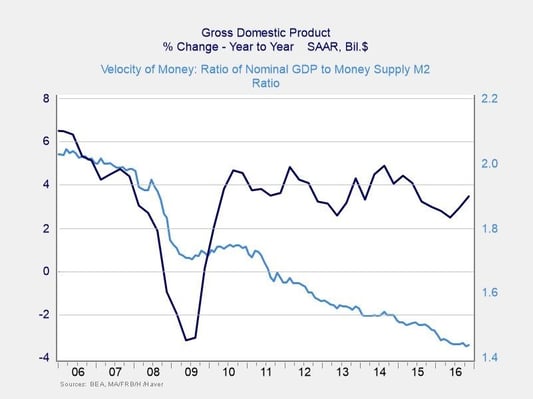

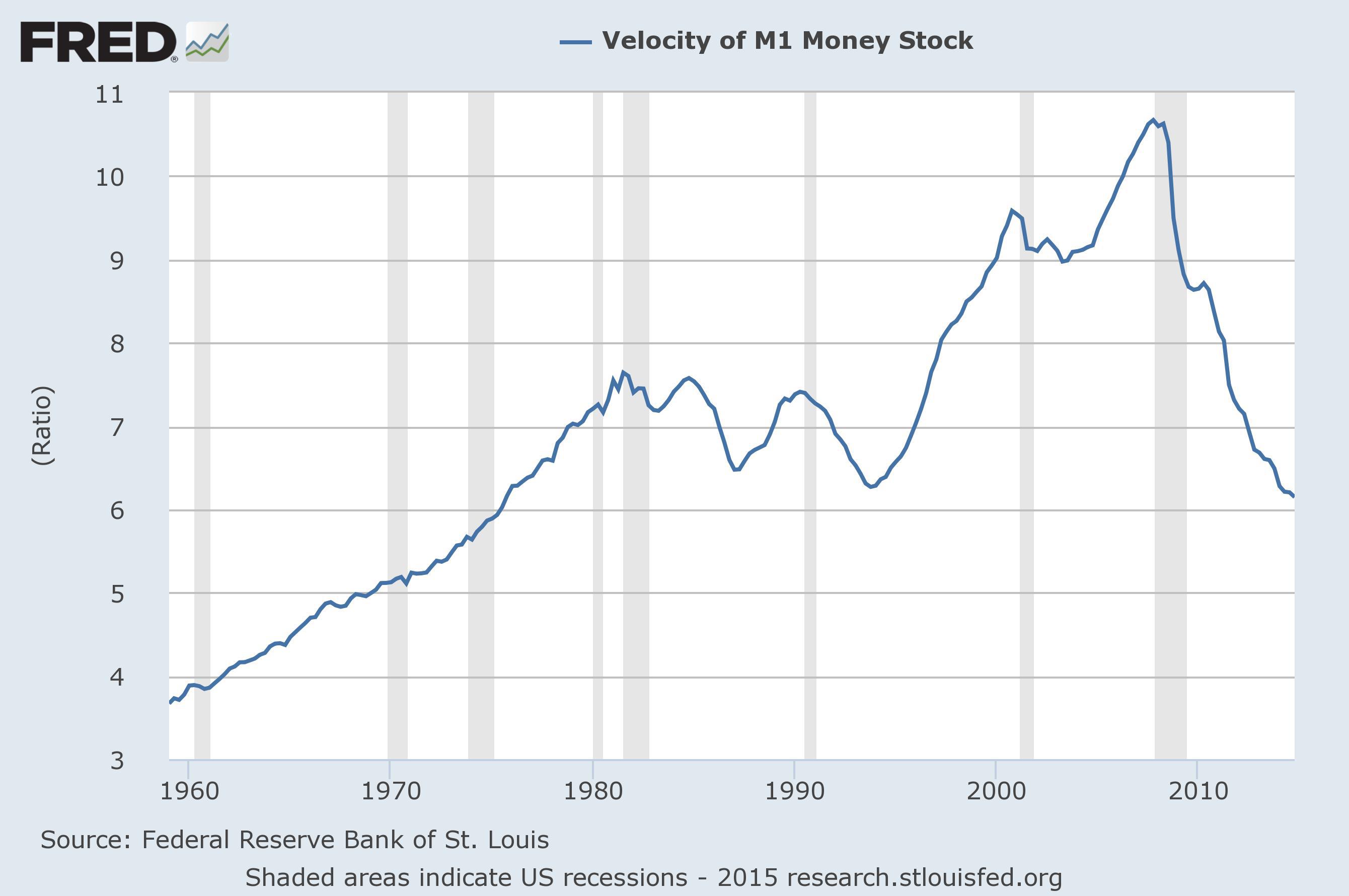

Money Supply x Velocity = Nominal GDP. - Velocity represents the number of times (per year) money (one unit of currency) is used to purchase goods and services.

- Classical theory assumption: velocity is constant.

- Corresponds to classical 'transactions' theory of money demand: money is used to buy goods and services. An increase in money supply (M) will lead to an increase in the desired level of transactions (P x Q).

- Calculations:

- calculate velocity given money supply and nominal GDP;

- calculate velocity given money supply, average price level, and real GDP;

- calculate nominal GDP given money supply and velocity;

- calculate real GDP given money supply. velocity, and average price level;

- et cetera. - Classical theory assumption: real output is always at full-employment output.

Vertical aggregate supply curve, - Classical theory implication: increase in money supply leads to inflation:

with both velocity (V) and real output (Q) constant, an increase in M leads only to an increase in P;

total output, national income, and interest rates are unchanged;

changes in money supply and the average price level are directly proportional;

an increase in money supply, which leads to an increase in the desired level of transactions, leads to price inflation where the quantity of goods and services avilable for sale is xonstant. - Classical theory implication: both fiscal policy and monetary policy are ineffective.

The economy should be left alone (laissez faire) so that flexible prices and interest rates will return economy to full employment output.

1. The classical quantity theory of money theory states that:

a. when money supply increases, interest rates fall.

b. the demand for money is inversely related to the interest rate.

c. money supply times velocity equals the price level times total real output.

Answer: C. The quantity theory of money is M V = P Q, where M = money supply, V = velocity of money, P = average price level, and Q = total real output. Answers (A) and (B) are interesting because they are true, but because of a different theory - Keynesian speculative demand for money.

2. The available M1 money supply is $100 and nominal GDP is $1,000. Applying the quantity theory of money we can conclude:

a. the velocity of M1 money is 0.10.

b. the velocity of M1 money is 10.0.

c. the price level is much higher than it should be.

d. prices are rising in the economy.

Answer: B. Note that nominal GDP equals P (prices) times Q (quantities). Since the quantity theory of money is M V = P Q, we have $100 V = $1,000. Therefore, V = velocity of money = 10.0.

3. Which of the statements below does not accurately represent the classical quantity theory of money?

a. Short-run changes in the price level will yield short-run changes in the money supply.

b. An increase in the quantity of money relative to a given quantity of goods and services causes inflation.

c. Changes in the money supply provide a reliable prediction of changes in nominal GDP over the long-run.

Answer: A. Answer (A) misses the mark because it is a change in money supply that changes the average price level. Answer (C) is true because of the underlying assumption of the quantity theory that the velocity of money is constant. If velocity is not constant then the effect of an increase on money supply on nominal GDP (P Q) would be unpredictable. Answer (B) is also true because of the joint classical assumptions that velocity is constant and output is at the full-employment level and is unaffected by changes in money supply.

2. The Short-run Keynesian View

Summary

- Rearrange quantity theory of money in terms of real money demand: M / P = (1 / V) x Q.

- Keynes proposed real money demand also a negative (inverse) function of interest rates: M / P = k Q - h i.

- Keynes theory implication: velocity not constant

- Keynes theory implication: price level unaffected by changes in money supply

- Monetary Policy Works Through Interest Rates

- Interest Rates Affect Aggregate Demand through Investment

- Keynesian theory implication: monetary policy is ineffective.

1. The Keynesian Speculative Demand for Money theory states that:

a. when money supply increases, interest rates fall.

b. the demand for money is inversely related to the interest rate.

c. the money supply times velocity equals the price level times total real output.

Answer: A and B. Answer C represents the classical quantity theory of money. We should recognize in answers A and B that the change in the interest rate could be very small. In the Keynesian Liquidity Trap when interest rates are very low (bond prices are high) people may expect interest rates to rise (the price of bonds to fall) in the near future. People may be willing to hold any increase in money supply with little impact on interest rates or total spending, holding onto the money until bond prices fall.

For the next two questions assume money demand in an economy is (note the Keynes money demand equation will be given):

Where, Md = money demand, P = average price level, Q = real output, and i = nominal interest rate.

2. If P = 10, Q = 1000, and i = 0.10, what are the values for real money demand, nominal money demand, and velocity?

Answer: Real money demand = Md/P = 100 + 0.2 (1,000) - 500 (0.10) = 250. Nominal money demand = Md = 250 x P = 250 (10) = 2,500. Velocity = nominal GDP / nominal money demand = P x Q / Md = 10 (1,000) / 2,500 = 4

3. Starting with the values of the variables in questions 2, what happens to velocity when here is an decrease in the nominal interest rate from 0.10 to 0.05?

How To Calculate Velocity Of Money With Real Gdp Equation

Answer: Real money demand = 275. Nominal money demand = 2,750. velocity = 3.64. A decline in the interest rate, which increases money demand without changing real output or the price level lowers the velocity of money. With the introduction of interest rates in the Keynesian model velocity is no longer constant.

4. Friedman and the Monetarists

1. According to Monetarists, which of the following is believed to reduce the ability of discretionary fiscal policy to eliminate demand-deficient unemployment?

a. recognition lags

b. response lags

c. the crowding-out effect

d. all of the above

e. none of the above

Answer: D

2. Following his election in 1962, President Kennedy pushed for a tax cut to stimulate economic growth. A tax-cut bill was finally enacted in 1964. What is the two-year period between these two events known as?

a. a recognition lag

b. an implementation lag

c. a response lag

d. a distributed lag

Answer: B

File last modified: November 1, 2004

How To Calculate Velocity Of Money With Real Gdp And Interest Rate

© Tancred Lidderdale (Tancred@Lidderdale.com)